Your pay slip explained

We haven’t made your payslip look so complicated on purpose – it’s to show that we’re complying with legislation.

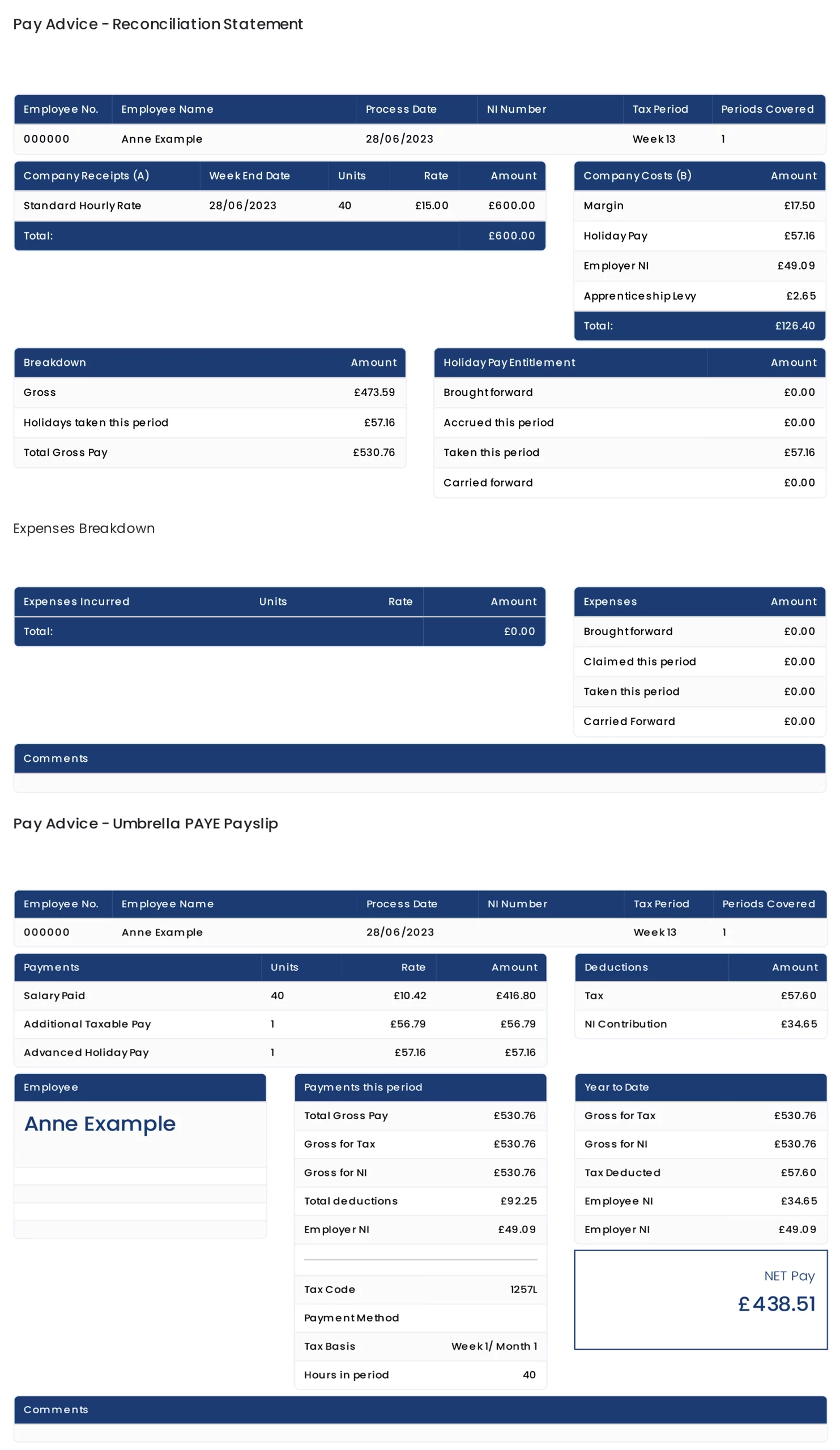

The diagram below explains what’s happening with your hard-earned cash, but if you have any questions just get in touch with us.

Please hover over the areas of the pay slip that you would like to find out more about.

This shows the money we receive from your agency.

The total received is subject to our margin and when applicable the employment costs of Employer NI, Employer Pension and Apprenticeship Levy.

This box displays your holiday pay allowance. If you are on advanced holiday, your holiday pay will always be paid out on each payslip.

If you are on retained holiday you will see how much you have accrued on this payslip and how much is available in your pot to request.

Gross: This is the number on which your holiday pay is calculated.

Holidays taken this period: shows how much holiday pay has been taken this period.

Total Gross Pay: is gross plus any holiday pay paid out this period.

It is also the amount on which Employer NI, Employer Pension and Apprenticeship Levy (each when applicable) are calculated.

Your Total Gross Pay then is split into the following:

- Salary Paid – which is your hours x National Minimum Wage (NMW)

- Additional taxable pay – which is the remaining part of your income outside of NMW calculations

- Holiday Pay – if applicable any holiday pay paid out this period

Your tax is calculated on the Gross for Tax figure and displayed here.

Your NI is calculated on the Gross for NI Figure and displayed here.

If applicable your work placed pension contribution will be displayed as well.

The bit you’re most interested in – Net Pay.

This is your take home pay.